Is This Fall the Right Time to Buy a Home? Here’s What’s Changing

For the past couple of years, buying a home has felt out of reach for many people. Home prices soared, mortgage rates climbed, and many hopeful buyers hit pause in their search for a new home. You might have been one of them.

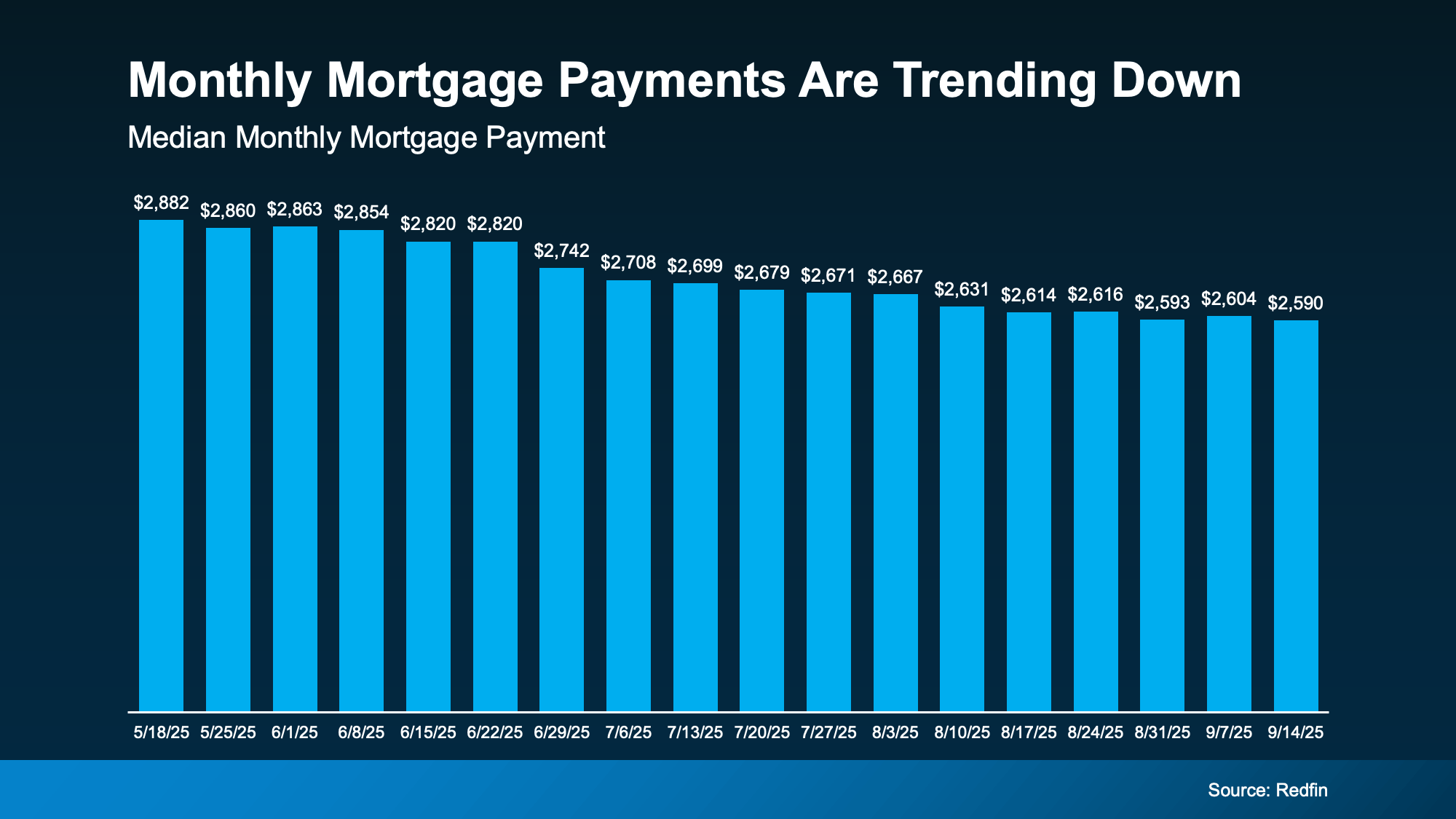

However, this fall is starting to bring some encouraging news. Affordability is finally showing signs of improvement. According to the latest data from Redfin, the typical monthly mortgage payment is about $290 lower than it was just a few months ago. This shift could significantly impact buyers who are ready to re-enter the market.

So, what’s behind this change? It comes down to three main factors: mortgage rates, home prices, and wages. For the first time in a while, all three are moving in a better direction. Let’s break it down.

-

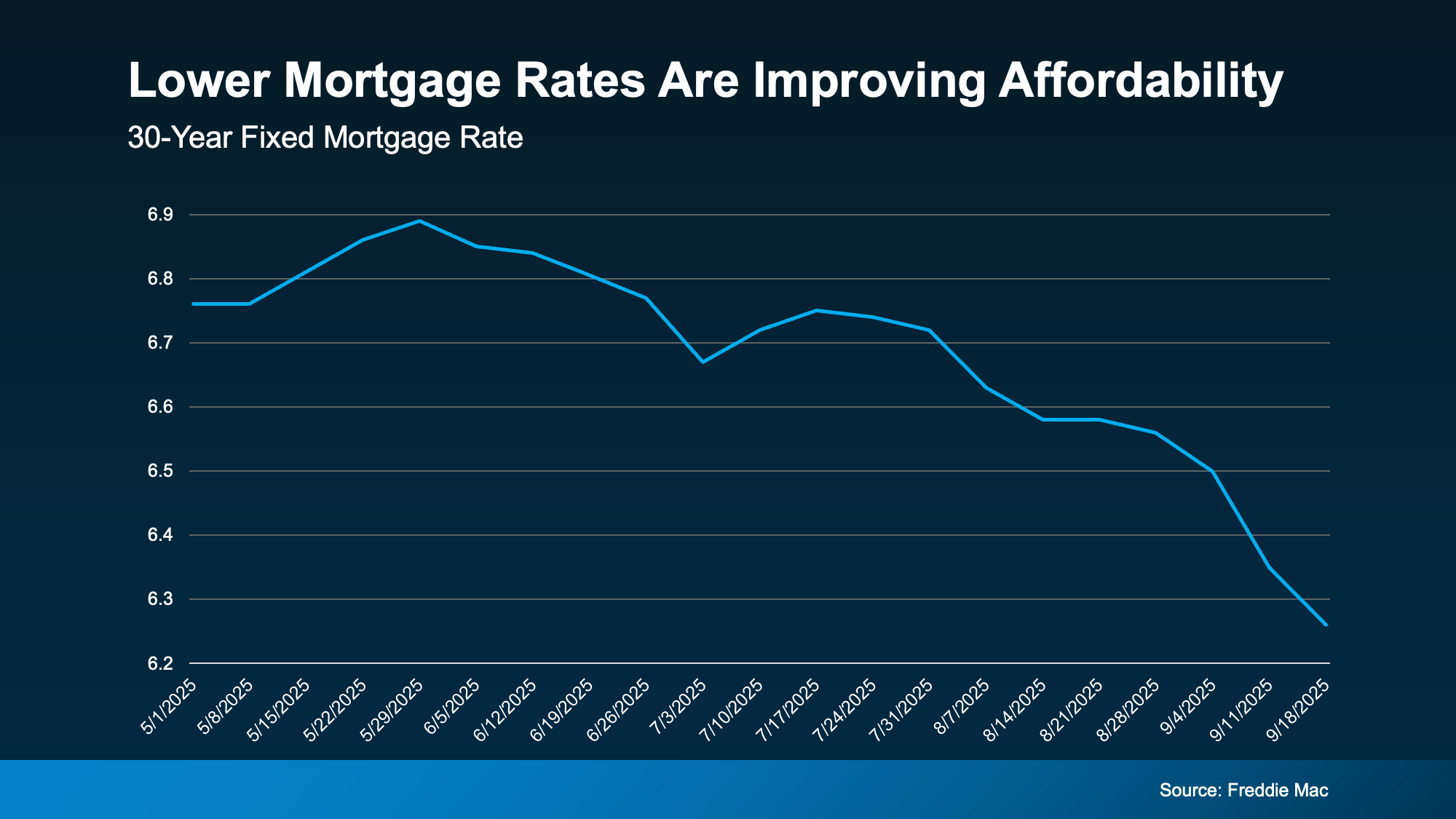

Mortgage Rates Are Easing

Rates aren’t back to the ultra-low levels of a few years ago, but they have decreased compared to earlier this year. In May 2025, rates were around 7%, while they are now approximately 6.3%. This may not sound like a significant difference, but even a small drop can greatly affect your monthly payment. For example, on a $400,000 mortgage, this change reduces the monthly payment by about $190.

As Joel Kan, Vice President and Deputy Chief Economist at the Mortgage Bankers Association (MBA), noted on September 10:

“The downward rate movement spurred the strongest week of borrower demand since 2022. Purchase applications increased to the highest level since July and continued to exceed last year’s pace by more than 20 percent.”

For some buyers, these savings alone make homeownership possible again.

-

Home Price Growth Has Slowed

After years of sharp increases, home prices are finally starting to stabilize. Nationally, prices are still rising, but at a much slower rate. Odeta Kushi, Deputy Chief Economist at First American, states:

“National home price growth remains positive but muted—low single digits—and we expect this trend to continue in the second half of the year.”

For buyers, this is welcome news. Slower growth makes it easier to budget and plan for the future. Additionally, in specific markets, prices have even dipped slightly, creating opportunities for those who’ve been waiting for the right deal.

-

Wages Are Rising Faster Than Home Prices

According to the Bureau of Labor Statistics (BLS), wages have increased by about 4% year over year. This is significant because, for the first time in a while, wage growth is outpacing home price growth. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), puts it simply:

“Wage growth is now comfortably outpacing home price growth, and buyers have more choices.”

While buying a home may not be “easy,” it does mean that your income is stretching a bit further than it did before.

What This Means for You

Lower mortgage rates, slower price growth, and rising wages are creating an opportunity this fall. While affordability remains tight, the numbers are starting to favor buyers again. Remember, the typical monthly payment is already about $290 lower than it was earlier this year—that’s real money back in your pocket.

Bottom Line

If you’ve been considering whether it’s worth revisiting your homebuying plans, now may be a good time to take another look. Let’s run the numbers together, explore your budget, and see whether this fall is the season to turn window-shopping into key-turning.

Categories

Recent Posts

"My mission is to help people use real estate to achieve their dreams. If you or someone you know are considering buying or selling a home, give me a call!"